The common thinking today (so I am told) is that startups don’t need a business plan. That is misleading. While the formats (and attention spans) may have changed from long to short, chances are the first interaction with any investor will involve emailing some variation of your business plan.

Weeding out bad business plans is the investor’s first line of defense for weeding out bad businesses.

The investor’s viewpoint

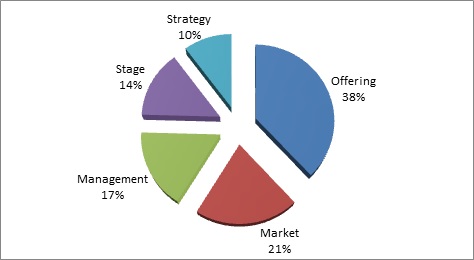

When I was an investment manager at an Israeli VC firm, I was asked by one of the universities to give a talk to their entrepreneurship club on the leading reasons that VC firms reject startups. I analyzed the data and saw that in 12 months we had rejected around 1,200 companies for the following reasons:

Let me explain the terminology

- Offering = usage case. The solution doesn’t fit the problem.

- Market = upside. Not enough people are going to buy it.

- Management = people. The team lacked the wow-factor or worse.

- Stage = too early. The case to invest is too weak so validation is needed.

- Strategy = business case. The path to monetization and growth are lacking.

And while these reasons are specific, I think we can further group the reasons for not investing into two categories: definitions and communication.

Definitions

In the startup formation stage, everything (product, target market, go-to-market strategy, etc.) is being defined and redefined repeatedly. At a certain point, decisions are made and the plan is finalized. Unfortunately, many decisions are wrong. I saw cases where technologies were productized into solutions that didn’t make sense. I saw many instances of business strategies that seemed like an afterthought. I saw founders make every mistake possible in building their teams. All of these mistakes were avoidable. All of them made the companies uninvestable.

The gaps between the startup’s definitions and the definitions that will make the startup investable need to be constantly re-evaluated and addressed. This is not a one-time reality check. Dropping the ball here is a fundamental error and will lead to wasted time and frustration in pitching investors and running the business.

Ever since I switched sides from being a VC to being on the side of startups, I have always insisted that for every startup I work with (and there have been over 200 in the past five years), I first perform an initial assessment of their investability. This includes a thorough review of the business plan, financial model, and investor presentation (the written communication), a meeting or call with the startup (the verbal communication), and a few open discussions with some investor friends to get feedback from the people whose opinions matter most.

Without exception, this process has benefited all my clients and has given them feedback on “the gap” and what needs to be done in order to close it.

I highly recommend it for anyone who wants to improve their odds.

Communication

Many years back I had a call with a startup founder after not being able to make heads or tails of his business plan. For 30 minutes he walked me through his business plan and answered my questions. Overall it sounded really interesting and worth moving forward. After the call I looked again at his business plan and did not see any connection between what I heard on the call and what I was reading.

This is not uncommon. Over the course of 12 years in venture capital, I reviewed thousands of companies, looked at their materials, met with them, had calls, and more often than not, the message did not come across in writing. (I am purposely not discussing the ones whose message did not come across in meetings, as they were not investable.)

Not every investor is willing to speak with and certainly not meet with a company whose materials are not clear (and this is an understatement). The reason I was: I had a sneaking suspicion that the gap between the verbal message and the written message was quite large, and I was right. Repeatedly. Without mentioning names, one of the companies that we later invested in and sold for over $300M had sent me an executive summary that even after reading several times, made zero sense. So it’s really not just the “bad” companies.

This means that even with the best technology, product, and business strategy, the inability to communicate it properly in writing is a major handicap and regretfully a very common occurrence.

Startups need to identify this gap. This can be done by working with a professional who is willing to invest the time and energy to understand the business, review the materials, and identify the communication gap between the two. Then, once fixed, you can be sure that your written materials convey the message and the strategy of your actual plan.

Closing the gaps – three steps to fix up ship

So what can you do to close these two very important gaps? Here are three simple steps:

Step one is to realize you might have a problem. If you have read the above and are still here, then hopefully this step is done.

Step two is to take a reality check. It’s really hard to take a step back and fix this problem alone. It’s also hard to get honest feedback from your team. My best advice is to pitch the startup to someone new who knows nothing about it. If possible, find someone who is willing and able to act like an investor would. Try to get as much detailed feedback as possible from the superficial (communication) to the core (definitions).

Step three is to do an honest gap analysis. Map out where you stand on every point versus where you would want to be. For example, how does your current team compare to your dream team? Next list the steps that should be taken to close the gap. Also list the limitations. Once you are done divide the list into things that can be done pre-financing, i.e. now, versus things that will have to wait until after financing. Knowing your weak points and being aware of what needs to be improved is a strength in and of itself. Finally, fix what can be fixed.